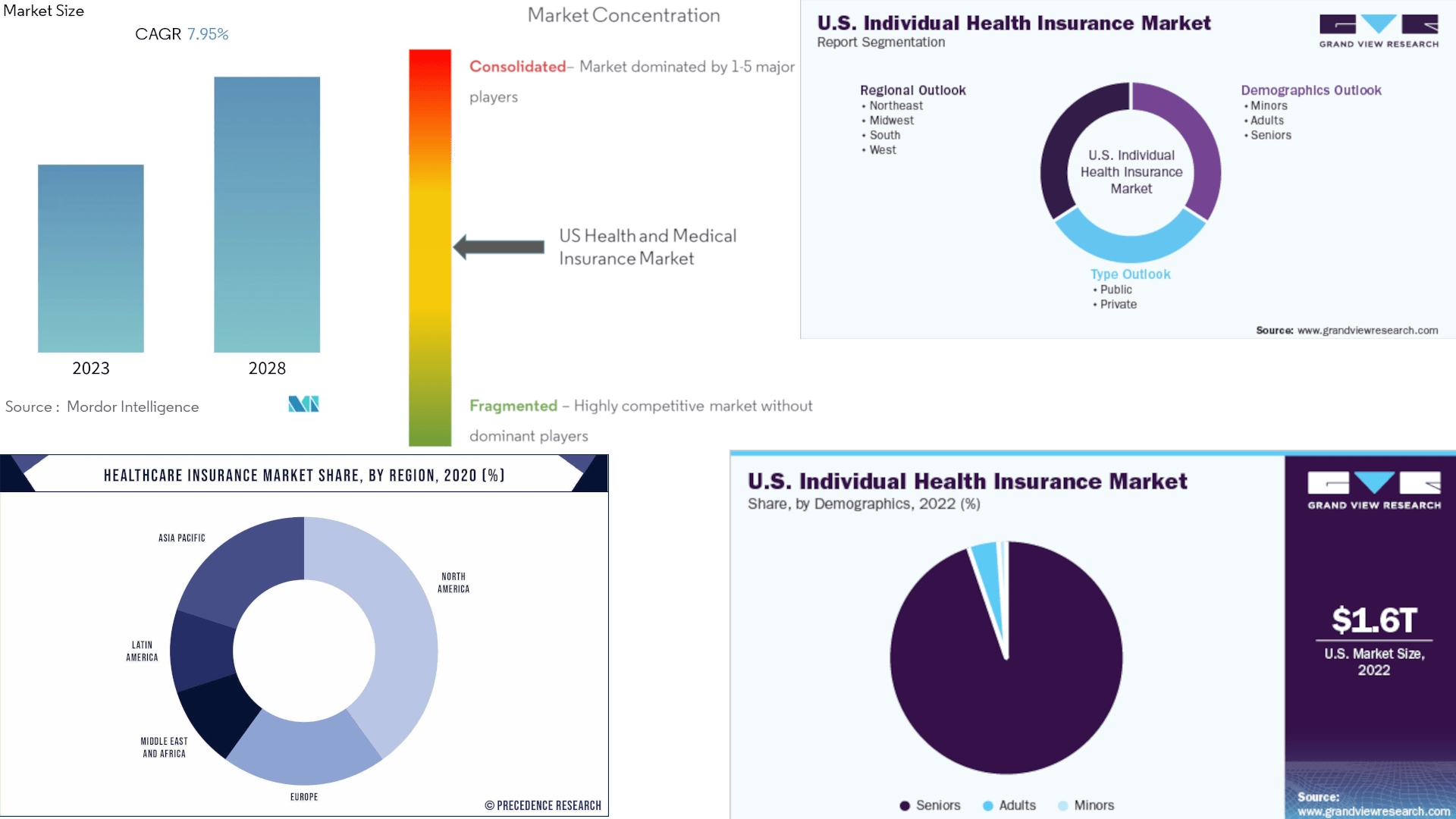

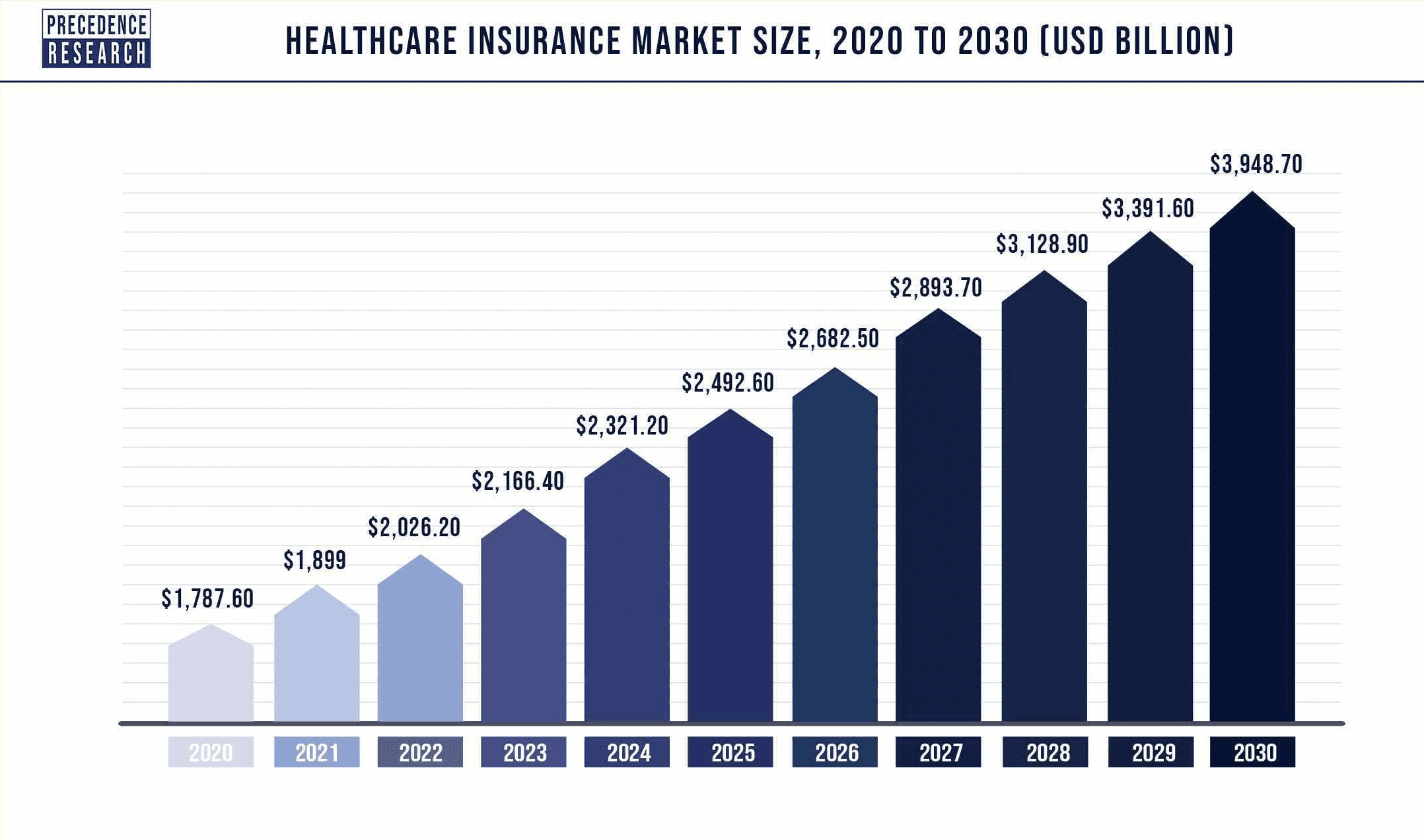

The Global Health Insurance market size was valued:

2021 USD 2.098 Trillion

2022 USD 2.241 Trillion

by 2030 USD 3.793 Trillion

Source: Global HLTH Insurance Market Report 2023

Source of graph: PrecedenceResearch

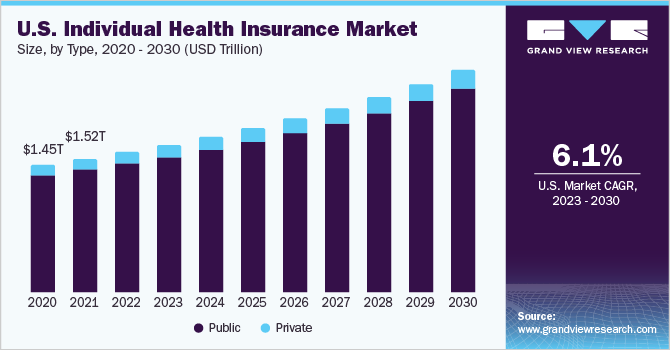

The U.S. individual health insurance market size was valued:

2022 USD 1.60 Trillion

by 2030 USD 2.54 Trillion

Source: GrandViewResearch

Facts:

On September 3, 2020, the domain name Insurance.com sold for $35.6 million at a GoDaddy auction, setting

a new record for the most expensive domain name ever sold.

Why HLTHinsirance.com?

“HLTH” is a recognizable abbreviation in the health sector, rendering the domain

keyword-rich and relevant.

Direct association with the health insurance industry, providing instant recognition

and relevancy in the market.

The uniqueness of the spelling enables brand distinction, providing a canvas to build

a

memorable and distinct online presence.

A keyword-rich domain that potentially escalates SEO rankings, driving organic traffic and aiding in

establishing a dominant digital presence.

A straightforward and catchy domain that effortlessly embeds itself in the consumer's mind, optimizing

recall and enhancing brand visibility.

Asset Appreciation: Domain names, especially those that are industry-relevant and easy to recall,

represent a sound digital asset.

More to ask

Frequently Asked Questions (FAQ)

The global health insurance market size was valued at USD 2.17 trillion in 2022 and it is predicted to surpass around USD 4.37 trillion by 2032

Source: Published:July 2023The global health insurance market is expected to grow at a CAGR of 7.3% from 2023 to 2032.

Source: Published:July 2023The major players operating in the health insurance market are:

WellCare Health Plans, Inc.

National Insurance Company Limited

The demand for the health insurance is expected to grow at a burgeoning pace owing to the rising awareness regarding the benefits of health insurances among the consumers, growing burden of diseases, rising elderly population across the globe, growing penetration of internet, and rising popularity of the insurance policy aggregators.

Source: Published:November 2021North america region will lead the global health insurance market in the

mentioned forecast period.

The five largest health insurance companies by revenue are:

UnitedHealth Group

CVS Health Corporation

Anthem

Kaiser Permanente

Centene and Humana

Source:

Published:Oct 2, 2023

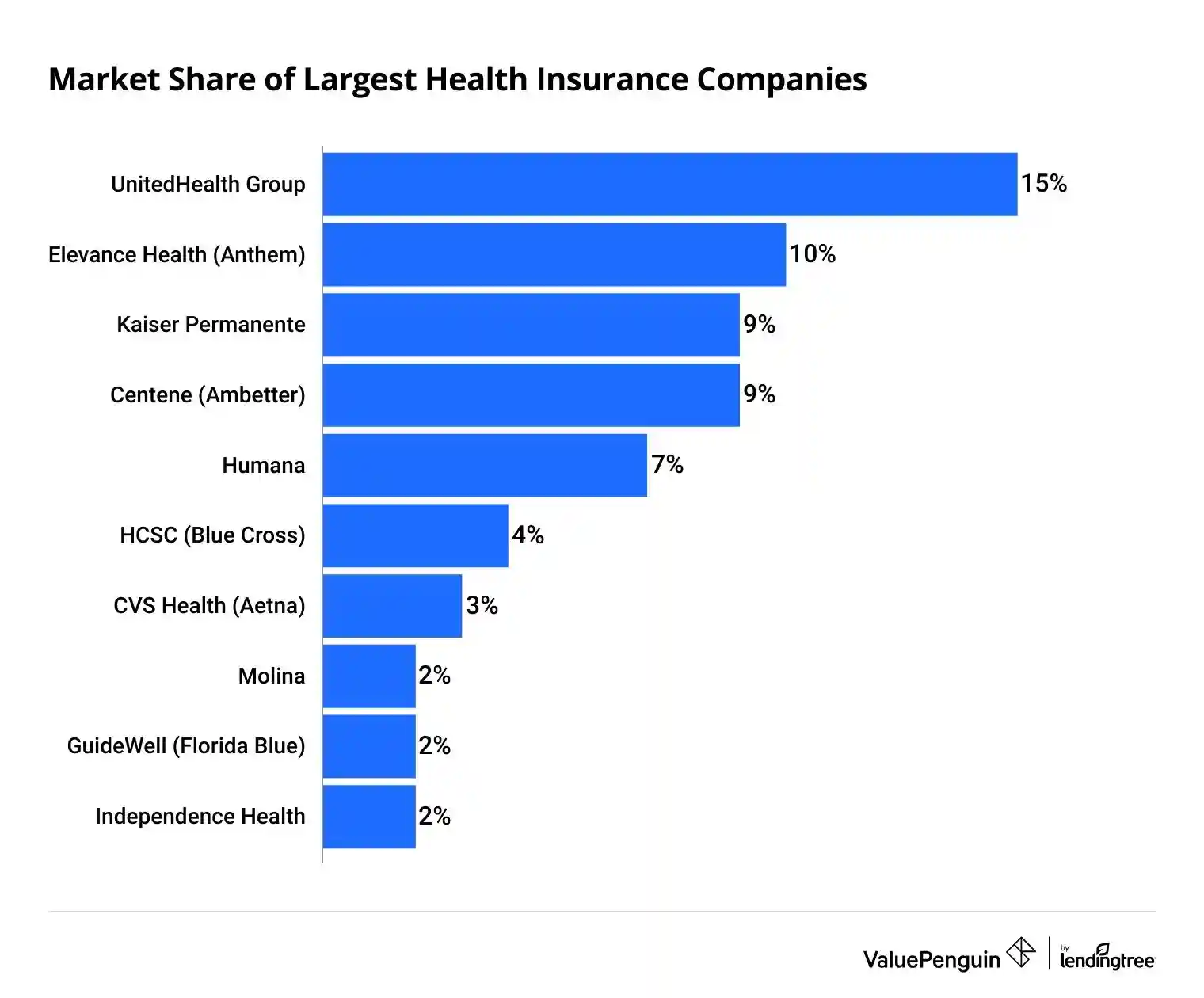

The five largest health insurance companies by revenue are:

| Company | Market share | Revenue (billions) |

|---|---|---|

| UnitedHealth Group | 15% | $189 |

| Elevance Health (Anthem) | 10% | $124 |

| Kaiser Permanente | 9% | $114 |

| Centene (Ambetter) | 9% | $110 |

| Humana | 7% | $86 |

| HCSC (Blue Cross) | 4% | $50 |

| CVS Health (Aetna) | 3% | $41 |

| Molina | 2% | $29 |

| GuideWell (Florida Blue) | 2% | $27 |

| Independence Health Group (Blue Cross) | 2% | $26 |

Hospital revenue sources breakdown into a payor mix of private insurance

companies and government insurance programs like Medicare and Medicaid.

The percentage of the total payor mix from private/self-pay revenue reached 68% in 2020, reflecting

market dynamics like private insurance companies compensating hospitals at a higher rate than

government programs and increasing Medicare Advantage enrollment.

The Definitive Healthcare ConnectedCareView product tracks key metrics on over 1,200 payor and payor

subsidiary organizations. The following list highlights the largest 20 payors (excluding payor

subsidiaries) based on total incurred claims for calendar year 2020, the most recent full year of data

available.

Source:

Published Feb 20th, 2023

| PAYOR NAME | STATE | TOTAL INCURRED CLAIMS | COVERED LIVES |

|---|---|---|---|

| Kaiser Permanente Health Plans | CA | $48,190,589,886 | 9,257,115 |

| UnitedHealthcare (AKA UnitedHealth Group) | MN | $31,197,766,592 | 7,266,859 |

| Elevance Health (FKA Anthem Blue Cross & Blue Shield) | IN | $30,985,209,365 | 5,837,538 |

| Health Care Service Corporation Group | IL | $27,089,269,607 | 5,012,197 |

| Guidewell Mutual Holding Group (FKA Blue Cross and Blue Shield of Florida) |

FL | $13,889,381,085 | 2,375,334 |

| Centene Corporation | MO | $13,418,778,596 | 2,644,427 |

| Blue Shield of California | CA | $12,195,926,108 | 2,397,370 |

| Aetna | CT | $11,884,017,306 | 2,436,521 |

| Cigna | CT | $11,628,634,678 | 2,203,802 |

| CareFirst BlueCross BlueShield | MD | $7,195,025,341 | 1,356,715 |

| BlueCross BlueShield of Michigan Group | MI | $6,395,661,082 | 1,446,414 |

| Highmark | PA | $6,061,050,336 | 1,200,581 |

| BlueCross Blue Shield of NC Group | NC | $6,031,728,568 | 1,011,974 |

| BlueCross BlueShield of Massachusetts Group | MA | $5,218,911,620 | 880,201 |

| Horizon Blue Cross Blue Shield of New Jersey | NJ | $5,096,699,541 | 800,870 |

| BlueCross BlueShield of Alabama Group | AL | $4,640,722,164 | 907,023 |

| Humana Group | KY | $4,239,355,565 | 777,097 |

| Independence Blue Cross Group | PA | $3,767,306,513 | 811,687 |

| EmblemHealth | NY | $3,379,255,409 | 500,117 |

| Regence | OR | $3,330,774,479 | 747,541 |